There has been a lot written recently about FinCEN’s duty to validate BOI data, but hardly anyone has stopped to think about how FinCEN would be able to validate BOI data.

Should FinCEN Validate BOI Data?

At this point, faithful readers know that FinCEN’s CTA regulations take effect on January 1, 2024. Under FinCEN’s Reporting Rule, a reporting company must file a BOI Report that identifies each of its beneficial owners. The report must provide, for each beneficial owner, the beneficial owner’s full legal name, date of birth, home residential address, a unique identifying number (such as a drivers license or passport) and an image of the document that contains the unique identifying number.

Companies that exist before January 1, 2024 will have one year to file their first report. Companies formed on or after January 1, 2024 will need to file their first report within thirty days after formation.

FinCEN will collect BOI data from reporting companies in a massive database. Under its proposed Access Rule, FinCEN will make BOI data available to U.S. law enforcement, U.S. banks and certain foreign law enforcement agencies for the purpose of combatting money-laundering and terrorism financing.

Criticism for FinCEN’s Failure to Validate BOI Data

FinCEN has come under criticism in some quarters for failing to implement a system to validate the BOI data it receives from reporting companies.

The CTA statute required FinCEN adopt regulations that would not only collect BOI data but would also be “highly useful . . . . [in] confirming” the beneficial ownership information reported by banks and financial institution’s under FinCEN’s already-implemented Customer Due Diligence (“CDD”) rules. 31 U.S.C. 5336(b)(F)(iv)(II).

Some in Congress, such as Blaine Luetkemeyer (R-Mo.) have questioned whether FinCEN’s approach goes far enough in making BOI data “highly useful.”

Interest groups like the FACT Coalition have argued that FinCEN needs to do more than simply collect BOI data. They claim it needs to validate BOI data as well.

“The Corporate Transparency Act represents nearly a decade of tireless work by a bipartisan group of lawmakers, experts, and advocates, and its passage in 2021 was the most substantial legislative anti-money laundering victory of this generation,” said Ian Gary, executive director of the FACT Coalition. “In order to realize the promise of this achievement, it is absolutely critical that FinCEN make important changes on the road to faithful implementation.”

The FACT Coalition argues that FinCEN’s proposed reporting forms include fields that would appear to allow a reporting entity to simply claim not to be able to determine statutorily required identifying information for each beneficial owner. If left unamended, FACT Coalition argues, the FinCEN form will functionally make beneficial ownership reporting optional under the CTA, in direct contravention of the mandatory statute and intent of the law.

“FinCEN only gets one shot at this final rule,” said Gary. “At a time when the Biden Administration has raised the profile of the international fight against corruption, Treasury’s FinCEN needs to avoid stumbling this close to the finish line. The language and intent of the CTA are clear: collected beneficial ownership information should be accurate, complete, and useful to authorized users. FinCEN’s second final rule to implement the CTA must reflect that.”

FinCEN Takes a Second Look

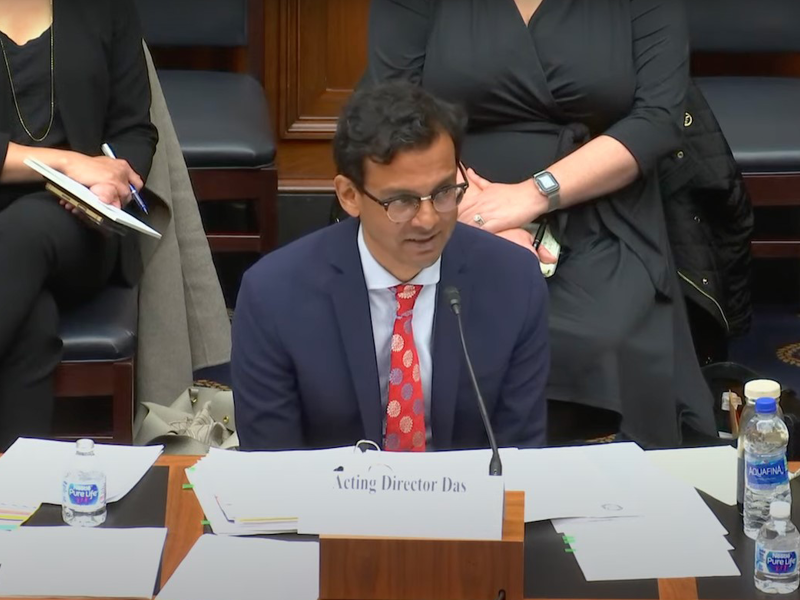

Acting Director of FinCEN, Himamauli Das, testified last week before the House Financial Services Committee on the agency’s progress towards the implementation of the Corporate Transparency Act.

In his testimony, Acting FinCEN Director Das said ”We heard loud and clear the importance of validation and we agree with the importance of validation. There are legal considerations, cost considerations, and then a number of questions with respect to how to implement validation as well.”

Changing FinCEN’s approach with only eight months remaining before the CTA takes effect will prove difficult. The Acting Director’s testimony did not make clear how FinCEN would seek to validate BOI data submitted by reporting companies.

How FinCEN Could Validate BOI Data

FinCEN could, in theory, validate these data points in several ways. A reporting company’s BOI Report is already submitted by a senior officer of the reporting company under penalty of perjury. So, in a meaningful sense, the reporting officer is validating the accuracy of the data through the very act of filing the report.

It might be theoretically possible for FinCEN to cross-check certain data points by other means. For example, the name and residential address of a beneficial owner might be cross-checked against the tax returns available in IRS records for the beneficial owner. But, there is no regulatory pathway for that kind of cross-checking currently and the data collected in the BOI Report does not include a beneficial owner’s SSN. If FinCEN had intended to cross-check with tax records, it should have required SSN numbers in its BOI Report rule.

Another possibility would be for FinCEN to cross-check BOI data against the reporting company’s Schedule K-1 (at least for those reporting companies that are taxed as partnerships). But even this would leave gaps, since (a) it would not address non-partnership reporting companies (that don’t issue Schedule K-1) and (b) Schedule K-1 recipients would not always correlate with beneficial ownership. (Non-natural persons can receive a Schedule K-1, but only natural persons can be beneficial owners under the CTA.) I discussed this concept in Episode 6 of our Podcast series.

What FinCEN would truly need, in order to validate BOI data with a high degree of accuracy, is a “validation engine” that would cross-check a reported company’s BOI data with (a) available tax data from the reporting company, and (b) other available data relating to beneficial owners. Such a validation engine does not exist, however, and it is not clear how FinCEN would be able to create one using the CTA as its only justification.

Perhaps FinCEN will delay its attempt to validate BOI data until after the first year of BOI reporting is completed by January 1, 2025. At that point, with one year of data collection complete, FinCEN would have a better grasp on the level of compliance and a better ability to forecast how a system of validation might work.

Bi-partisan Congressional interest in this subject ensures that it will not fade away. U.S. companies should begin implementing procedures to collect BOI data from their investors to make the compliance process easier. U.S. companies should adopt amendments to their shareholder agreements and LLC operating agreements that require investors to make their BOI data available for reporting purposes. U.S. companies should also engage with counsel to make sure they are able to identify the beneficial ownership who will need to be covered by their reports after the January 1, 2024 implementation date.