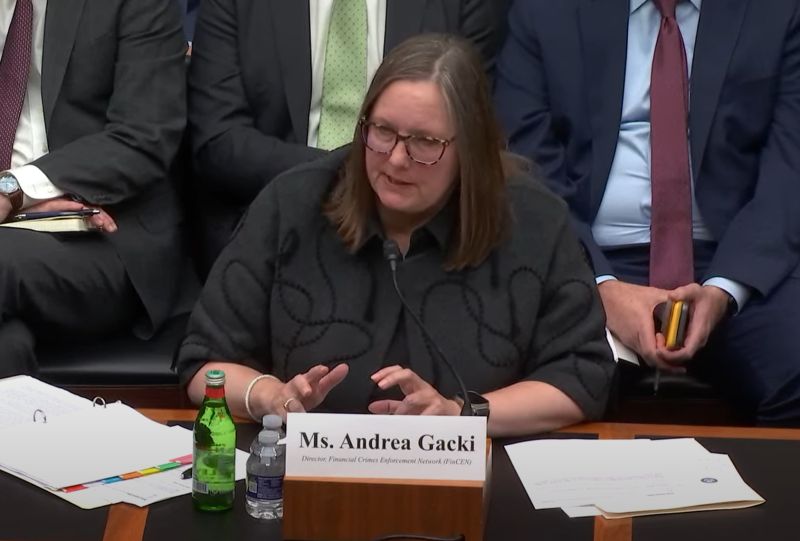

So FinCEN is implementing a new anti-money laundering regulation. “But will they really go through with it?” you ask. Whether FinCEN is going to go through with their Dec 1, 2025, deadline is a good question to ask. FinCEN Director Andrea Gacki answered that question under oath, just a few weeks ago.

The CTA Debacle: Could It Happen Again?

We all remember the multi-year run-up to the Corporate Transparency Act (CTA) deadline. Congress passed the CTA at the end of 2020, and FinCEN finally issued a final set of regulations in 2022, so that they took effect at the beginning of 2024. Companies formed after January 1, 2024, were the guinea pigs, having 90 days from the date they were formed to file beneficial ownership information (BOI) reports.

By late 2024, there were multiple federal lawsuits pending, and courts were issuing injunctions left and right. Through December 2024 and into the new year, lawyers and business owners watched the appellate litigation unfold, including a few trips to the Supreme Court.

Just as it appeared that the judicial system was going to rule in favor of the constitutionality of the law, the newly appointed Treasury Secretary effectively iced the entire program. The “Interim Final Rule” (as it was called) exempted all U.S. individuals from having to file. Only non-U.S. residents (probably fewer than 100,000 worldwide) remained subject to the CTA filing regime.

For many, it seemed like years of preparation, education, and planning had been wasted. The government’s last-minute shrug seemed arbitrary and improvised. We wondered what it had all been for.

Now, less than a year later, it seems like we might be doing it again.

The Real Estate Rule

FinCEN’s residential real estate rule (the “RRE RUle”) requires closing attorneys and title agents to file reports with FinCEN for certain residential real estate transactions where there is no mortgage loan issued by a traditional mortgage lender and where the transferee (or buyer) is a non-individual entity or trust. (Read our prior posts here and here for more details.)

Closing attorneys and title agents are wondering whether they should gear up to comply with the new regulations – which take effect December 1, 2025, or whether they can count on a pro-business administration to simply put the kibosh on the whole arrangement at the last minute.

This time just might be different.

FinCEN Director’s Testimony Before Congress

At the September 9th hearing, Rep. Williams (R-TX) challenged FinCEN Director Andrea Gacki on the steep compliance costs of the residential real estate transfer rule. He pointed to FinCEN’s estimates of 800,000 individuals affected, over 4 million hours of compliance work, and $630 million in costs—warning that the rule could raise housing prices. Williams asked whether FinCEN would delay or rescope the rule to ease the burden on small businesses.

Director Gacki stood firm. She highlighted more than a decade of experience with Geographic Targeting Orders (GTOs), which have required reporting on shell company real estate purchases and proven “incredibly beneficial to law enforcement.” She stressed that the benefits of transparency outweigh the costs and confirmed that FinCEN expects the rule to take effect in December 2025.

When pressed on the burden for small businesses, especially title companies, Gacki acknowledged the challenge but pointed to ongoing outreach and training efforts. She also noted that if more time is truly needed, FinCEN may explore ways to provide it—but emphasized that the rule is still on track for implementation.

What This Means for Industry Professionals

FinCEN is moving full speed toward the December 1, 2025, effective date of the Residential Real Estate Reporting Rule. Director Gacki made clear that the agency views this regulation as critical to protecting the U.S. financial system from abuse by shell companies. While she acknowledged the burden on small businesses and left the door open for possible adjustments, the message was unmistakable: the rule is coming.

The takeaway: Closing attorneys, title agents, and compliance professionals should act now—learn the requirements, train staff, and put reporting procedures in place. Hoping for a last-minute delay, as happened with the CTA, is a gamble that could leave firms unprepared.