Insights on The Corporate Transparency Act

Stay informed and ahead of the curve with the FinCEN Report blog. Here, you’ll find the latest insights, tips, and updates on the Corporate Transparency Act, financial compliance, and best practices for business owners and trusted advisors. The CTA, effective from January 1, 2024, requires the disclosure of beneficial ownership information (BOI) to help combat financial crimes. Our expert contributors provide valuable content to help you navigate this new regulatory landscape. Whether you’re looking for detailed guides or quick tips, our blog is your go-to resource for all things compliance. Stay knowledgeable and stay compliant with FinCEN Report.

Court Rules that CTA is Constitutional

No Blanket Exemption for Homeowner and Community Associations On October 24, 2024, the Federal District Court for the Eastern District of Virginia handed down a ruling that effective ends the debate over whether Homeowner and Community Associations will need to file BOI reports under the Corporate Transparency Act (CTA) in 2024. The bottom line for Associations is that they will...

How to Solve the Problem of Uncooperative HOA Board Members

The Boards of homeowner associations, condo associations and other residential real estate community associations are learning about what the Corporate Transparency Act will require of them. Each association will need to file an initial beneficial ownership information (BOI) report before January 1, 2025. Each BOI report will need to contain specific items of personally identifiable information (PII) about each board...

Litigation Challenges to the CTA & What It Means for Your Clients

The Waiting Time is Over: Prepare Now to File Your BOI Reports. Reporting companies that are not exempt need to file their beneficial ownership information (BOI) reports under the Corporate Transparency Act no later than January 1, 2025. Business owners in the U.S. by now have been flooded by news reports and client memos from law and accounting firms alerting...

Who Is Considered a “Beneficial Owner” under the Corporate Transparency Act (CTA)?

What is a BOI Report and Who Is Considered a Beneficial Owner? In order to comply with the Federal Corporate Transparency Act (CTA), your company will need to file what's called a BOI Report. BOI stands for Beneficial Owner Information. Your company’s BOI report will need to identify each of your beneficial owners. Determining Your Beneficial Owners A “beneficial owner”...

7 Steps for Compliance with the Corporate Transparency Act (CTA)

What Business Owner's Need to Know to Comply. If you are a business owner, considering for the first time how to comply with the Corporate Transparency Act (CTA), it may seem overwhelming. The CTA is a new Federal law that requires most U.S. companies to file a beneficial ownership information (BOI) report with FinCEN – an organization that will...

23 Categories of Companies Exempt from Corporate Transparency Act (CTA) Reporting

The Corporate Transparency Act (CTA) exempts 23 categories of companies that would otherwise be required to file beneficial ownership reports. FinCEN finalized its exempt company categories in Section 101.380(c)(2) of its Final Rule, so that each category of exempt entity is excluded from the definition of “reporting company”. Each exemption has specific legal requirements. If you guess incorrectly (and...

Is the Corporate Transparency Act Unconstitutional? What Businesses Need to Know.

In a ruling dated March 1, 2024, a federal judge in the Northern District of Alabama ruled that the Corporate Transparency Act (CTA) [NTD: insert link to blog post on Final Rule] is unconstitutional. Though the federal appeals process for that ruling could take months or years, the important question facing business owners now is what should be done about...

What You Should Know About the BOI Information Access Rule

In December 2023 the Financial Crimes Enforcement Network (FinCEN) issued a final rule implementing the access and safeguard provisions of the Corporate Transparency Act (CTA) (the “Access Rule”). The Access Rule defines the terms under which beneficial ownership information (BOI) reported to FinCEN under the CTA may be disclosed to specified recipients. The Access Rule also imposes requirements on those...

FinCEN Confirms Most Homeowner Associations Will Need to File Under the CTA

In new FAQs published last week, FinCEN has confirmed that most Homeowner Associations will need to file under the CTA. For the past several years, advocates for Homeowner Associations and Community Associations have been hoping that these entities would be exempt from the Corporate Transparency Act. They asked Congress to amend the CTA. They asked FinCEN for an exemption. No...

Are All Company Board Members Considered Beneficial Owners?

Board Members and Beneficial Owners A reporting company that is preparing its first beneficial ownership information report (BOI report) under the Corporate Transparency Act (CTA) should consider whether it should identify each of its board members (or members of the board of directors) as beneficial owners. Although FinCEN’s regulations do not require a reporting company to list every member of...

FinCEN Report is Named an Atlanta Startup To Watch in 2024

The Atlanta startup is playing a timely and critical role in helping millions of businesses comply with the Corporate Transparency Act, while also combatting money laundering and financial fraud. FinCEN REPORT, a beneficial ownership reporting service that helps U.S. companies comply with the new Corporate Transparency Act (CTA), received the honor of being named in the Atlanta Inno’s 2024 Startups...

BOI Reporting Deadlines for Companies Formed in January 2024

Deadlines Are Looming For Companies Under the Corporate Transparency Act Corporations, LLCs and other companies formed during 2024 have a looming deadline to file their beneficial ownership information (BOI) reports under the Corporate Transparency Act. While many lawyers are focused on the task of completing BOI reports for pre-2024 entities that will be due by the end of 2024, entities...

How Accounting Firms Can Help Clients with the CTA

Accounting Firms and CPAs Are Uniquely Positioned to Help with the CTA Accounting firms and CPAs are in a unique position to assist their clients with the Corporate Transparency Act (CTA). The CTA is going to require more than 32 million companies to file beneficial ownership information (BOI) reports during 2024. Unfortunately, some articles on the topic have given some...

Corporate Transparency & the States: California SB 1201

Even as business owners and attorneys are struggling to learn about the federal Corporate Transparency Act, state legislatures are considering legislation to impose similar corporate transparency obligations on the state level. Earlier, we wrote about Maryland, where Senate Bill (SB) 954 proposes to require entities formed in Maryland to file a transparency report with the Maryland Department of Assessments and...

Corporate Transparency & the States: Maryland SB 954

Even as business owners and attorneys are struggling to learn about the federal Corporate Transparency Act, state legislatures are considering legislation to impose similar corporate transparency obligations on the state level. One of these is Maryland, where Senate Bill (SB) 954 proposes to require entities formed in Maryland to file a transparency report with the Maryland Department of Assessments and...

Dissolution and the Corporate Transparency Act

Dissolution and the CTA Updated 7/10/24 A frequent question at our Corporate Transparency Act webinars is whether an entity that dissolves before December 31, 2024 would still be obligated to file a BOI report. Until recently, this was a subject of some debate. FinCEN’s regulations were not entirely clear. In July 2024, however, FinCEN updated the FAQs on its...

What Does FinCEN Mean by “Similar Office” Under the CTA?

What Office is Similar to the Secretary of State Under the CTA? A key question when determining whether an entity is a reporting company under the Corporate Transparency Act (CTA) is whether the entity was formed by the filing of a document with “a secretary of state or any similar office under the law of a State or Indian tribe.” ...

CTA Beneficial Ownership Reporting Challenges in Community Property States

Inset: This post was co-authored with Joe Wallin, a partner in the Seattle, Washington office of Carney Badley Spellman. The Corporate Transparency Act (CTA) took effect January 1, 2024. This new federal law will require non-exempt reporting companies to report personally identifiable information for each beneficial owner (each, a “BOI report”) to FinCEN. Each BOI report will need to identify...

Who is Required to File a BOI Report Under the CTA?

Now that the Corporate Transparency Act has finally taken effect, many have questions about who can be a “filer” and who is liable for filing a BOI report under FinCEN’s Reporting Rule. Some lawyers and accountants have worried that they might become liable if their clients fail to report correctly. Some corporate service providers have worried that they might be...

Who is a Company Applicant?

Who is a Company Applicant? There has been some consternation among law firms and corporate service providers about “who is a company applicant” under the Corporate Transparency Act. FinCEN revised its BOI FAQs last week to provide further guidance on that question. Who is a Company Applicant? The definition of “company applicant” is contained in FinCEN’s Reporting Rule. Although the...

Calculating Beneficial Ownership: Applying the Failsafe Rule

In some prior posts (The Capital Calculation Rule, The Partnership Capital Rule and The Corporate Capital Rule), I described the logical operation of FinCEN’s Reporting Rule. The Reporting Rule creates a standard for determining whether the reporting company should calculate percentage ownership under the Partnership Capital Rule or the Corporate Capital Rule. The Partnership Capital Rule is a means for...

Calculating Beneficial Ownership: Applying the Corporate Capital Rule

Calculating Beneficial Ownership: Applying the Corporate Capital Rule In some prior posts (Beneficial Ownership Under the Corporate Transparent Act: The Capital Calculation Rules and Calculating Beneficial Ownership: Applying the Partnership Capital Rule), I described how FinCEN’s Reporting Rule for preparing BOI reports required the reporting company to determine whether it was subject to the Partnership Capital Rule or the Corporate Capital Rule....

Calculating Beneficial Ownership: Applying the Partnership Capital Rule

In a prior post (Beneficial Ownership Under the Corporate Transparent Act: The Capital Calculation Rules), I described how FinCEN’s Reporting Rule for preparing BOI reports required the reporting company to determine whether it was subject to the Partnership Capital Rule or the Corporate Capital Rule. In this post, I am going to de-construct the Partnership Capital Rule and outline how...

FinCEN Extends Deadline for Companies Created or Registered in 2024

FinCEN – the Financial Crimes Enforcement Network of the U.S. Treasury – on November 29th announced that it was issuing a final rule to adopt its proposed rule extending the filing deadline for reporting companies formed or registered to do business during 2024. FinCEN announced that the extension will give reporting companies created or registered in 2024 more time (90...

Frequently Asked Questions about the Corporate Transparency Act

Frequently Asked Questions about the Corporate Transparency Act I recently presented an overview of the Corporate Transparency Act (CTA) to a room full of nearly 100 lawyers. Here are a few questions I received and the answers I gave: Question: Understanding that in some cases there is a substantive reason for not disclosing certain owners, in many, if not most,...

Beneficial Ownership Under the Corporate Transparency Act: The Capital Calculation Rules

Business owners and their lawyers need to understand the capital calculation rules for beneficial ownership reports under the Corporate Transparency Act. These rules vary based on the form of the entity. The CTA will require more than 35 million businesses to file a beneficial ownership information (BOI) report with FinCEN. Each BOI report must provide specific items of personally identifiable...

FinCEN Corporate Transparency Act FAQs

FinCEN Corporate Transparency Act FAQs On November 16, 2023 FinCEN issued additional FAQs on their website to answer new questions about the reporting process, reporting companies, beneficial owners, company applicants, reporting requirements, initial reports, and reporting company exemptions. Importantly, readers should note that FinCEN’s FAQs are “explanatory only and do not supplement or modify any obligations imposed by statute or...

Treasury Appoints New Director of FinCEN

The Treasury Department today announced the appointment of Andrea Gacki as the Director of the Treasury Department's Financial Crimes Enforcement Network (FinCEN). Ms. Gacki presently serves as the Director of the Office of Foreign Assets Control (OFAC) at the Treasury Department. She has previously served as the Treasury Department's Under Secretary for Terrorism and Financial Intelligence (TFI). "I am honored...

New York LLC Transparency Law

Just when you thought you might be figuring out the Corporate Transparency Act, along comes the New York LLC Transparency Act to add to the confusion of all. The New York LLC Transparency Act. The New York Assembly in late June passed a bill (AO3484) entitled the "LLC Transparency Act." New York Governor Kathy Hochul has not yet signed the...

Treasury Promises to Amend BOI Report Form

Treasury officials promise to amend their proposed form of BOI Report with an improved form of beneficial ownership report

How FinCEN Might Validate BOI Data

Thinking about whether FinCEN should validate BOI data and how FinCEN might validate BOI data.

FinCEN Unveils Form for Beneficial Ownership Reports

FinCEN unveils its form for beneficial ownership reports and its form of application for FinCEN Identifier

The CTA Compliance Hub System is Patent Pending

The CTA Compliance Hub System is patent pending. This patent pending solution helps business owners file beneficial ownership reports with FinCEN.

What is a Shell Company?

I sometimes run across the question, "What is a shell company?" You hear the term shell company, or sometimes shell corporation, used all the time on police TV shows. The police captain walks into the squad room. "What's the latest on the murder investigation?" he asks. The nerdy-looking policeman at a computer screen says, "We tracked them to a building...

Business New Year’s Resolution

A Business New Year's Resolution: Prepare for the Corporate Transparency Act. Business owners and business lawyers should know that the Corporate Transparency Act takes effect on January 1, 2024. That means that 2023 will be the last year in which entrepreneurs and business lawyers will be able to form companies without almost simultaneously filing a beneficial ownership report. When Are...

Treasury Warns Cryptocurrency Mixers on Money Laundering

Treasury Warns Cryptocurrency Mixers on Money Laundering Concerns

FinCEN Geographic Targeting Orders

FinCEN Geographic Targeting Orders obligate title companies to report beneficial ownership information

FinCEN Geographic Targeting Orders Expanded and Extended

FinCEN is extending its geographic targeting orders through April 2023 and expanding its geographic targeting orders to include Houston, Texas and Laredo, Texas

FinCEN Final Rule on Beneficial Ownership Reports

FinCEN Final Rule on Beneficial Ownership Reports, outlining who must file and the information and timing required in beneficial ownership reports

Beneficial Ownership Reports, Final Rule, 31 CFR 1010

Final rule for beneficial ownership reports under the Corporate Transparency Act

Breaking News: FinCEN Issues Final Regulations

FinCEN announced today that it was issuing final regulations to implement the Corporate Transparency Act. The rule will require most corporations, limited liability companies, and other entities created in or registered to do business in the United States to report information about their beneficial owners—the persons who ultimately own or control the company, to FinCEN. In its press release, Acting FinCEN Director...

Experts Question FinCEN Delays

Experts question FinCEN's delay in implementing the Corporate Transparency Act

CTA and EU Privacy Laws

In this video, my law partner Mitzi Hill and I discuss challenges for businesses complying with the Corporate Transparency Act and EU privacy laws. The EU data privacy directive obligations EU member states to adopt data privacy laws in harmony with the director. EU data privacy laws restrict how businesses may collect personally-identifiable information ("PII") of EU residents, use and...

Canadian AML Laws Grow in Scope

Canadian anti-money laundering laws continue to grow in scope and depth. Attorneys from the Canadian firm of Borden Laden Gervais write about expanding efforts by Canada's Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) to impose AML obligations on payment service providers (PSPs) and other FinTech firms. They write: The government's declaration of a public order emergency in February 2022 went away as...

Love and Money Laundering

A District of Columbia accountant was charged with criminal money laundering in connection with an online romance scam.

FinCEN Report Company Podcast

FinCEN Report Company founder speaks on a podcast about the Corporate Transparency Act

Canadian Corporate Transparency

Like the U.S. Corporate Transparency Act, recent developments in Canada will soon require private corporations in Canada to report beneficial ownership information to Canadian regulators. (Hat tip: Davies Ward Phillips & Vineburg has published an excellent summary.) Like their American cousins, Canadian regulators are implementing a multi-year effort to create a national registry of private company beneficial ownership. Amendments to the CBCA Require Beneficial...

American Law Institute CLE Presentation on CTA

American Law Institute CLE Presentation on Corporate Transparency Act

U.S. Leads the World in Money Laundering

The U.S. leads the world in money laundering, according to a new report. Implementing the CTA would begin to curb this problem.

Senators Urge Funding for FinCEN

A bipartisan group of Senators is urging Congress to fund FinCEN fully to implement the Corporate Transparency Act

Rubio Urges Implementation of CTA

Senator Marco Rubio and Senate colleagues are urging the Treasury Department to implement the Corporate Transparency Act

New York LLC Transparency Act

Legislators in New York are considering the New York LLC Transparency Act.

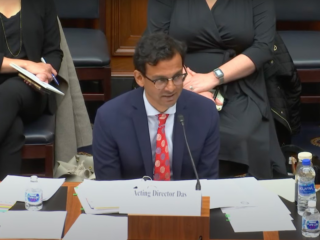

FinCEN Director Congressional Testimony

FinCEN Director Him Das testified before the Committee on Financial Services of the U.S. House of Representatives on April 28, 2022.

FinCEN Publishes CTA Regulations

FinCEN today published its initial draft regulations to implement the Corporate Transparency Act. Regulators had previously published an advanced notice of public rulemaking to explore issues surround the CTA. FinCEN expects to publish the proposed regulations in the Federal Register tomorrow. (Updated December 8, 2021: Here is the Federal Register citation.) The Corporate Transparency Act required FinCEN to implement regulations before December 31, 2021. It...

Congress Members Disappointed with Slow Pace of CTA Implementation

Congress Members are disappointed with the slow pace of implementing the Corporate Transparency Act according to reporting in the Financial Times. The three Democratic committee chairs have written to Janet Yellen, expressing disappointment at the Treasury Department's slow pace. These committee chairs were instrumental in leading the adoption of the Corporate Transparency Act. According to the report, Sherrod Brown, Senate banking...

Beneficial Ownership Rules in Europe and the U.S.

Beneficial ownership rules in Europe and the U.S. are different but changing fast. As part of the National Defense Authorization Act of 2021 Congress adopted the Corporate Transparency Act (or "CTA"). The CTA includes some of the most significant changes to US anti-money laundering ("AML") laws in recent years. Despite an EU-wide mandate known as the Fifth Anti-Money Laundering Directive ("5AMLD"), however, EU member...

Five Things Your Business Can Do Now to Prepare for the Corporate Transparency Act

The Corporate Transparency Act requires the U.S. Treasury Department's Financial Crimes Enforcement Network - FinCEN - to adopt regulations before the end of the year to implement the law. FinCEN has not yet released those regulations. But, there are five things your business can do now to prepare for this new law. 1. Understand What the CTA Requires The CTA...

How America Became the Money Laundering Capital of the World

Peter Stone, an investigative journalist, claims that America has become of the "money laundering capital of the world."Stone claims that the U.S. earned this title because it lacks controls over money flows and financial accounts in his recent article in The New Republic. Stone describes some notorious examples, such as the "Russian Laundromat" case. In this, Vladimir Putin's cousin succeeded in laundering...